Even in times of greatest market volatility, it must never be forgotten how important it is to build a financial future beyond the working life . Especially in our country, characterized by a pension system that is often subject to revisions and modifications. Which does not allow, therefore, to have certainties about the future after work.

So, starting investing thinking about when your income stream will run out is never too late . But not too soon. The principle that “the sooner you start, the better” applies, but also that “it’s never too late to do it”. What is certain is that the later you do it, the less positive effects you can have in the future.

Supplementary pension and pension gap

You invest for your old age to fill what experts call the pension gap , which is the difference between what will be received by the state in the form of a pension and how much an individual would like to have, to live, once a career has ended. To make up for this gap, it is necessary to turn to the supplementary pension , that is, an additional pension to that of the national social security institution, in Italy the INPS.

What are the tools to invest for old age

But what are the best tools to create a supplementary pension? There are the classic pension funds (open or closed), or individual pension plans (the so-called PIPs), which also allow you to enjoy significant tax benefits. In the first case, the worker sets aside a portion of his earnings or – if an employee – of his severance pay (which is thus not left in the company). A contribution from the company can also be added for employees.

Individual pension plans, also known by the acronym PIP, are instead offered and managed by insurance companies, and are built on the model of life insurance with the difference that the event that triggers the disbursement of the pension annuity is not a life case or death case, but that’s when the beneficiary retires .

But investing for life after the work phase means setting aside and making your money return , compatibly with your risk profile and defending the investment from the erosion of inflation. All with a long-term time horizon. And to pursue these goals there are also other suitable tools, if used in the right way.

Time, an important ally

Time, in these cases, is a faithful ally. Understanding how to have a constant income, to capitalize it over time, makes the difference between an old age with many resources and one to live with some renunciation.

The compound capitalization system works for us : the earnings pursued in the individual periods are reinvested for the following periods, with obvious benefits for the growth of one’s capital.

So, how to invest for your old age?

As with any investment choice, the possibility of doing it yourself is worthwhile. For those who – of course – have the time, desire and knowledge. Features that not everyone can boast in their toolbox.

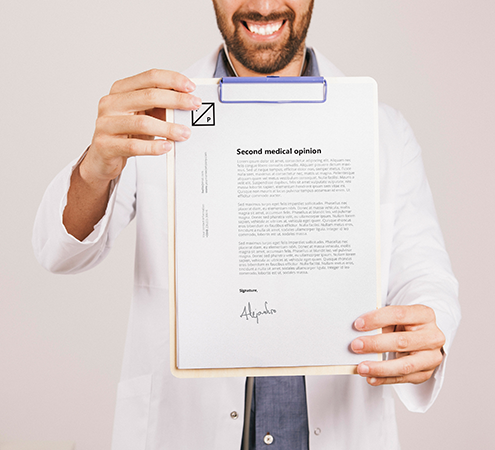

The simplest alternative is to turn to professionals , especially for such a delicate matter and with such a long-term horizon , who can guarantee the best possible asset allocation for one’s own risk profile and needs. And that they follow the evolution of the markets, rebalancing the investments in case the need arises.