Despite the increasing adoption of bitcoin by large financial institutions, the cryptocurrency still has some way to go to be considered a safe haven asset.

The price of bitcoin has been on a roller coaster ride for four years. In just the past two weeks, the price of the cryptocurrency hit a record high of $ 57,000 before falling below the 50,000 mark ($ 45,672 as of Feb. 26), according to Bloomberg.

The valleys and peaks of the cryptocurrency have been as many as those of an electrocardiogram. In this swing, bitcoin has amassed a market value of almost $ 1 trillion, and this level is beginning to attract even the most skeptical. The latest to join the queue were BlackRock, the world’s largest investment manager; Bank of New York Mellon, the oldest bank in the United States, and JP Morgan, by Jamie Dimon, who described bitcoin as a “fraud”, but who now has no alternative but to get involved in crypto in the interest of investors, according to his own co-chairman Daniel Pinto, in an interview with US television CNBC.

For some this is a clear example that the backing – and more importantly, the money put in – to bitcoin could turn it into a safe haven asset, just as gold is now. “It can be likened to ‘digital gold,'” says Édgar Castillo Huerta, finance professor at the Tec de Monterrey Business School. “It all depends on the trust the community has,” he added.

The comparison is not idle. The price of bitcoin in dollars is 26 times higher than that offered for an ounce of gold, taking as a reference the prices of last Friday that placed the cryptocurrency at 45,672 dollars and the ounce at 1,730 dollars, according to data from Bloomberg.

The cryptocurrency already serves as an active refuge for some entrepreneurs, such is the case of Elon Musk who put 1,500 million dollars in bitcoins in the belly of his company Tesla. Michael Saylor joined the bitcoinliever s by saving $ 2.4 billion in bitcoins at Microstrategy, the software company he co-founded and which has shareholders such as BlackRock, Vanguard and Morgan Stanley.

“I think there are positive indicators for bitcoin, especially in terms of adoption,” Javier Martínez, director of GBM digital, said in an interview. “The last cycle of 2018 to date has been a cycle that has given bitcoin a lot of confidence, because many institutional players have participated especially”.

The truth is that bitcoin still does not have the trajectory of gold, the confidence of most investors or an important piece in the financial system: regulators. The central banks of the European Union, the United Kingdom, Japan and the Federal Reserve of the United States have warned of the risks of investing in bitcoin. The latest warning was issued by Christine Lagarde, president of the European Central Bank, who said in an interview with Reuters that bitcoin is “highly speculative” and “that it has conducted shady deals.”

Volatility is one of the constants that we have seen in bitcoin in recent years. In a metaphor, it is similar to a wild horse that has yet to be tamed, and therefore, have reserve, according to Eduardo Recoba, financial economist and journalist for the digital portal La Mula in Peru.

“Nothing that pays you four times its value can be susceptible to an investment. There is a brutal speculation that has to force investors to think and rethink their strategy of investing in these digital vehicles, ”says Recoba in line with central bank reserves and other specialists reluctant to call bitcoin an asset.

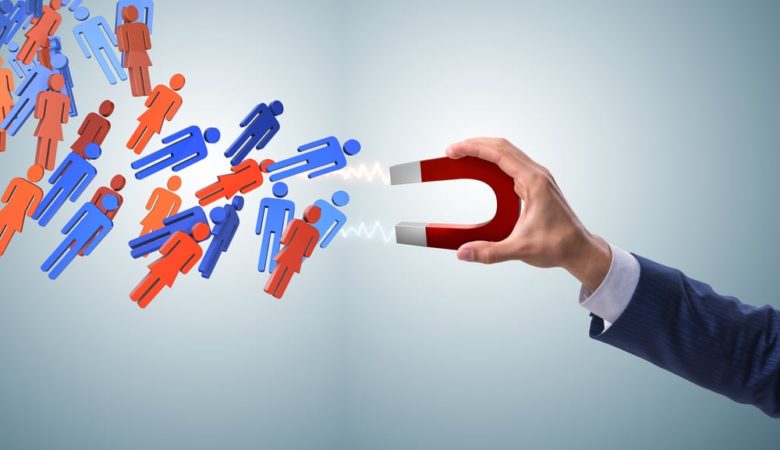

To ‘tame’ bitcoin, the interviewees agreed, regulators and more institutional investors are needed to stabilize the price. stability “, says Castillo, from Tec.” We need a means that is democrative and this is still missing for bitcoin, “he added.

For now, there is no one who advises to put all the chips in bitcoin, even less, the saved for withdrawal. But for Martínez, from GBM, it is a matter of time before digital natives gain greater purchasing power and adopt “something that makes more sense to them”.