Fear and greed are for the investor like the Cat and the Fox in Pinocchio’s fable: two bad advisors, which lead to losing one’s money rather than making it profitable.

Investing is like climbing Everest, not like playing Monopoly

Basically, any investment follows a basic criterion: there is no return without risk. In light of this principle, it is first of all necessary to avoid being paralyzed by fear, because to obtain profit from one’s savings one must face the uncertainty linked to the volatility of the markets, the return is nothing but the reward for having successfully faced it. But success is not guaranteed, otherwise there would be no risk that rewards those who face it in the form of returns . And the risks, as we know, must be faced with caution. That caution that greed easily leads to neglect. It is obvious, let it be clear, that those who invest are motivated by the desire to earn, it is not a question of not having this desire but… est modus in rebus.

Markets are to an investor what the Himalayas are to a climber: they can lead to the top, but it is difficult to get there alone, if not at the cost of rigorous training. Many online trading platforms allow you to do it yourself, without sherpa, and can also be seen as a gym.

However, training can be extremely expensive. Investing is not like playing Monopoly, because the money that you eventually lose is real. When investing it is therefore necessary to balance yourself well: to be afraid enough not to let yourself be taken by greed and vice versa not to let your desire to get rich go to the point of not seeing possible stumbles. How you do it? Recalling a lesson from Luigi Einaudi (economist by training): knowing to deliberate.Everything that is traded on the markets is evaluated, the price of what is treated is nothing more than the ‘vote’ consequent to that evaluation , and therefore knowing to deliberate means nothing more than understanding on the basis of which elements that vote is expressed and how it can change following the change of those elements. The good news is that those elements, called fundamentals, are all known and classified and follow rather precise rules in their combinations (finance is mathematics after all).

So why not go it alone? Because mathematics is indeed an exact science but also a difficult one, at least at certain levels, one could not even joke too much. The combinations of fundamentals are innumerable and it is necessary to have a good familiarity to imagine them all before deciding whether to invest. Then, in fact, a well-trained mind is needed to understand which result derives from a certain concatenation of fundamentals (it is a question of identifying the exact mathematical formula that expresses this concatenation and carrying out the relative calculation). And again, upstream, it takes time to analyze the fundamentals to be taken into consideration and identify the possible changes they may undergo. To give an example: a company that lands in a new market is certainly of interest to an investor, But what if the currency in which that company supports its production costs appreciates against the currency in which its new customers buy its products? Let’s just assume that the company’s business on the new market is booming for a long time before currency values reduce its profits. Those who invested in that company will find themselves with a lower return just when they had made a good mouth. And even worse would be the case in which he hasn’t even had time to get a good mouth.

The remedy for all this actually exists and is called diversification . To return to the previous example, in parallel to the trust placed in the company, the investor could buy instruments that protect him from currency fluctuations. However, it is necessary to know that there are similar tools, it is necessary to have the mental flexibility to think that they can be useful and finally, it is necessary to know how to balance the savings conveyed to the company and those directed to hedging instruments.

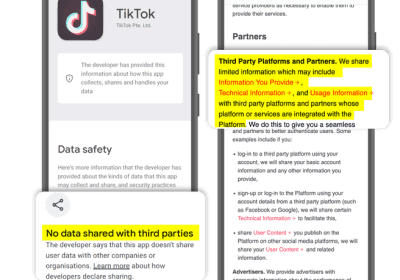

Diversifying, not focusing only on a target, however, again requires time, energy and money and contrasts with a certain laziness inherent in man. What psychology calls cognitive biases, the tendency to continue to follow one’s ideas even when the first evidence emerges that it would be good to change such ideas, risk being amplified by online trading. The latter is in fact, basically, an automatic executor, very fast of course but which limits itself to following the inputs that are given to it. It does not deal with analyzing fundamentals and providing, on the basis of that analysis, to give advice or alarm signals nor does it suggest on its own initiative to diversify the portfolio. He is, in short, a ‘foolish servant’,

Getting used to a certain trend is a literally suicidal behavior, as the story of the American turkey teaches: accustomed to seeing his master come to feed him every day, he runs to meet him even when Thanksgiving arrives and he becomes the master’s food. . The news episode from which we started tells us that online trading can make a turkey even the man who gives those platforms an uncritical trust, neglecting the structural limitations of those systems.